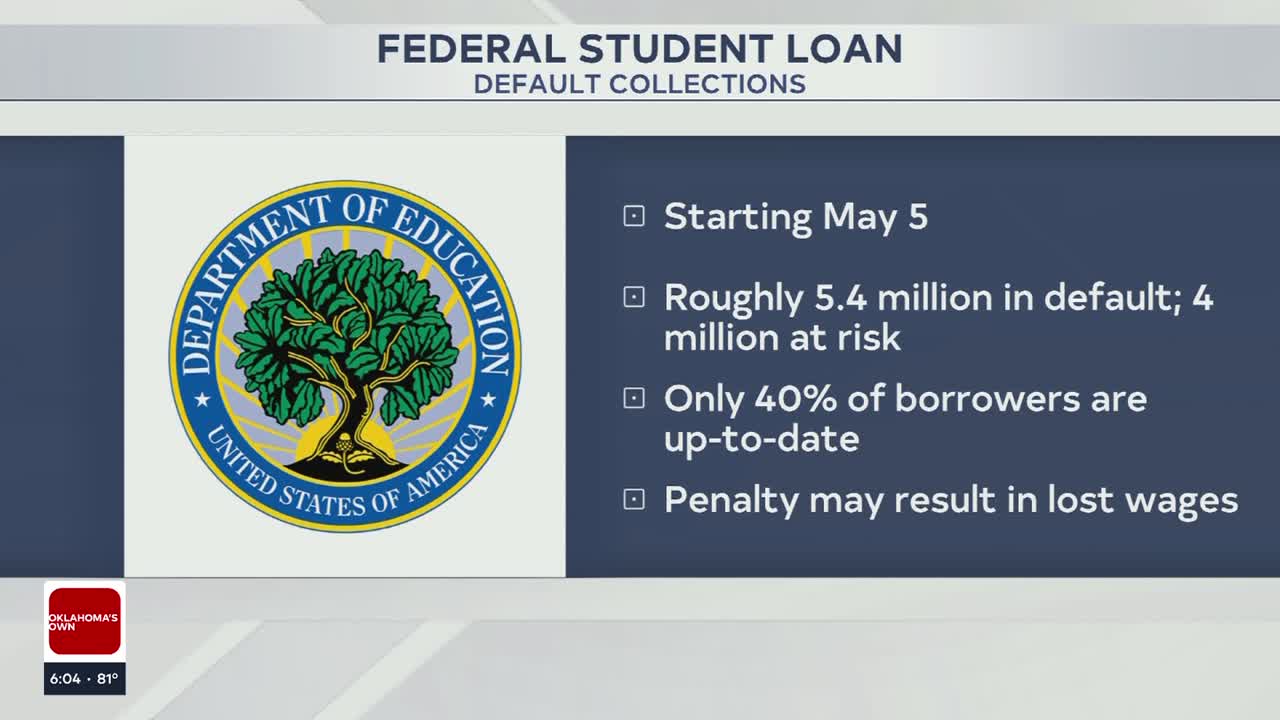

Defaulted on your student loans? Here's 5 things to know before collections hit

Student loan default collections resume May 5, 2025. Understand the risks and explore rehabilitation options to steer clear of potential financial pitfalls.Tuesday, April 22nd 2025, 2:06 pm

By:

Ethan Wright

TULSA, Okla. -

Are you up-to-date on your student loan payments? If not and you’re in default, you have a little more than a week to figure out a plan to start paying them back.

>>> Student loan borrowers in default face garnished wages, Education Department says

Here’s five things you should know about student loan default collections:

1. Collections Resume May 5

- After being paused since March 2020, the U.S. Department of Education will restart collections for student loans in default on May 5, 2025.

- Borrowers in default will receive an email with instructions on what to do next.

2. Millions at Risk

- Roughly 5.4 million borrowers are already in default.

- An additional 4 million are 90-180 days behind and could soon join them.

3. Most Borrowers Aren’t Current

- Only 40% of borrowers are up-to-date on their payments, according to the Department of Education.

4. Default Can Hit Your Paycheck and Credit

- After a 30-day notice, the government can garnish up to 15% of your wages, withhold tax refunds or Social Security benefits, and damage your credit score.

- Defaulted borrowers who don’t set up a payment plan may be sent to debt collectors.

- Once a loan is in default, the full balance (including interest) becomes immediately due — a process called acceleration.

5. Loan Rehabilitation Is an Option — Once

- Borrowers can enter loan rehabilitation by making nine on-time monthly payments.

- Payment amounts are based on income and expenses, but this program can only be used once.

6. Know Your Loan Status

- For anyone unsure of the status of their loan, you can visit studentaid.gov.

More Like This

April 3rd, 2025

April 1st, 2025

March 26th, 2025

Top Headlines

April 24th, 2025

April 24th, 2025