Wildfire damage? Here are 5 things insurance experts say you should do.

The Oklahoma Insurance Department is sharing guidance with residents affected by the fires and high winds that swept through the state on March 14. Here are some of their tips.Tuesday, March 18th 2025, 4:46 pm

OKLAHOMA CITY -

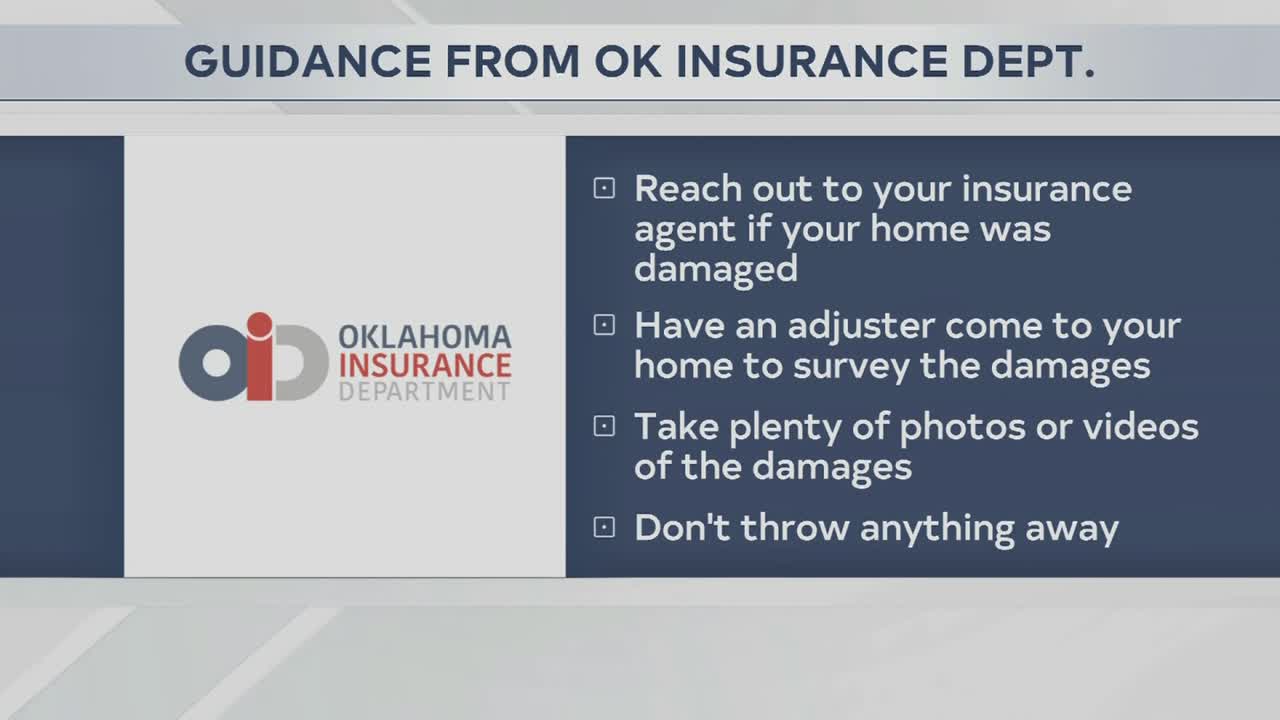

The Oklahoma Insurance Department is sharing guidance to residents affected by the fires and high winds that swept through the state on March 14.

1. Contact Your Insurance Company ASAP

Insurance experts recommend contacting your insurance agent or company as soon as possible if you’ve experienced significant loss. Ask about your additional living expense (ALE) coverage, which can help with temporary housing, clothing, and food costs during the recovery process, according to the Oklahoma Insurance Department.

2. Gather Necessary Information for Your Claim

Be sure to ask your insurer what information is needed to process your claim and provide your updated contact details if you can’t stay in your home. Experts also recommend taking photos of the damage before any cleanup, and keeping track of all expenses and receipts for potential reimbursement, according to the department.

3. Get Repair Estimates Before Filing a Claim

If the damage is minor, experts advise getting repair estimates before filing a claim and comparing the cost to your deductible. If the cost is close to or lower than the deductible, it may be best not to file a claim, according to the Oklahoma Insurance Department.

4. Take Steps to Prevent Further Damage

Once it’s safe to do so, make the necessary repairs to prevent additional damage, but avoid making permanent repairs until your insurance company has inspected the property and reached an agreement with you on the cost of repairs, according to insurance experts.

5. Protect Yourself From Contractor Fraud

Insurance experts urge residents to avoid contractor fraud by:

- Getting multiple bids for repairs.

- Checking references and verifying contractor licenses and insurance.

- Avoiding large upfront payments and contractors offering to waive deductibles (which is illegal).

- Ensuring all contracts are complete with no blank spaces before signing.

If you suspect contractor fraud, contact the Office of the Oklahoma Attorney General Consumer Protection Unit at 833-681-1895.

For more information on storm preparedness and insurance coverage, visit oid.ok.gov/GetReady, according to the Oklahoma Insurance Department.

Another story you may be interested in:

More Like This

March 18th, 2025

March 18th, 2025

March 18th, 2025

Top Headlines

March 18th, 2025

March 18th, 2025