Oklahoma Supreme Court says McGirt ruling does not exempt tribal citizens from state income taxes

The ruling means that tribal citizens who live and work on tribal lands are required to pay state income tax. Here's how that impacts the Stroble v. Oklahoma Tax Commission case.Tuesday, July 1st 2025, 5:15 pm

OKLAHOMA CITY -

The Oklahoma Supreme Court ruled Tuesday that tribal citizens are not exempt from paying state income taxes.

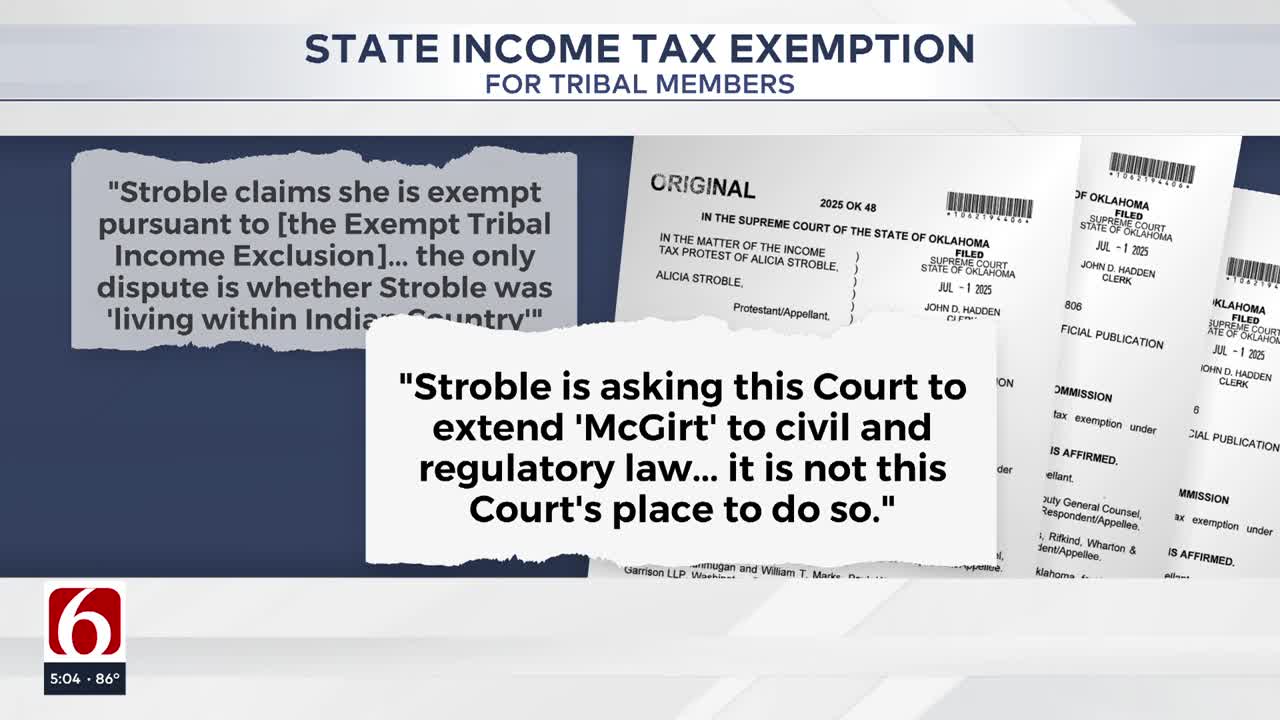

This stems from the Stroble v. Oklahoma Tax Commission case, where Alicia Stroble sued the Oklahoma Tax Commission after it denied her income tax exemption for tribal members, which applies to people who are part of a tribe, live on the reservation and work for the tribe.

The ruling means that tribal citizens who live and work on tribal lands are required to pay state income tax.

Stroble is a member of the Muscogee Nation, worked for the tribe, and lived in Okmulgee, which she argued is on the Muscogee Reservation based on the U.S. Supreme Court McGirt ruling on tribal jurisdiction.

Oklahoma Supreme Court justices say the U.S. Supreme Court ruling applied only to prosecuting crimes, not applying taxes, and say that since she does not live within the formal reservation boundaries, she does not qualify for a tax exemption.

Oklahoma Gov. Kevin Stitt issued the following statement after the court ruling:

“This is a big win for the future of Oklahoma. From day one, I’ve fought to make sure every Oklahoman is treated equally."

"Tribal governments, liberal groups, and some elected officials have pushed for special tax exemptions that would create a two-tiered system — one set of rules for tribal citizens and another for everyone else. That’s wrong. It would divide our state and weaken the public services every family relies on."

"This ruling makes it clear that attempts to expand McGirt into civil and tax matters have no basis in the law. We are one Oklahoma. And as long as I’m Governor, we aren’t going backwards.”

Statement from Muscogee Nation Principal Chief David W. Hill:

“The Muscogee Nation is disappointed in the Oklahoma Supreme Court’s ruling today in Stroble v. Oklahoma Tax Commission departing from well-settled law originally recognized by the United States Supreme Court over 50 years ago and that is inconsistent with the State’s own administrative tax rules.

Ever since the McGirt ruling, we have seen Oklahoma state courts go through legal gymnastics to come up with results that are not in compliance with federal law and that do not even follow pre-McGirt state court precedent on the limits of state authority in Indian country.

The Stroble ruling is another sad example of those antics. We know that this ruling could have broad implications for Indian Country, so we are carefully reviewing the decision with our legal team and preparing for the next steps.

While it is important to remember that the Muscogee Nation cannot provide legal advice on individual tax cases to citizens, the Nation will remain diligent in coordination and communication of what our response will be.”

Statement from Alicia Stroble:

“While I'm extremely disappointed with the Oklahoma State Supreme Court's Order, I still believe in the merits of the case and we are on the right side of the law. The legal team is reviewing options to determine the best course of action.”

Previous coverage: Oklahoma Supreme Court Hearing Arguments In Muscogee Nation Citizen's Tax Exemption Case

More Like This

July 1st, 2025

May 5th, 2025

Top Headlines

July 1st, 2025